Rumored Buzz on Estate Planning Attorney

Table of ContentsEstate Planning Attorney Can Be Fun For AnyoneExcitement About Estate Planning AttorneyTop Guidelines Of Estate Planning AttorneyAbout Estate Planning Attorney

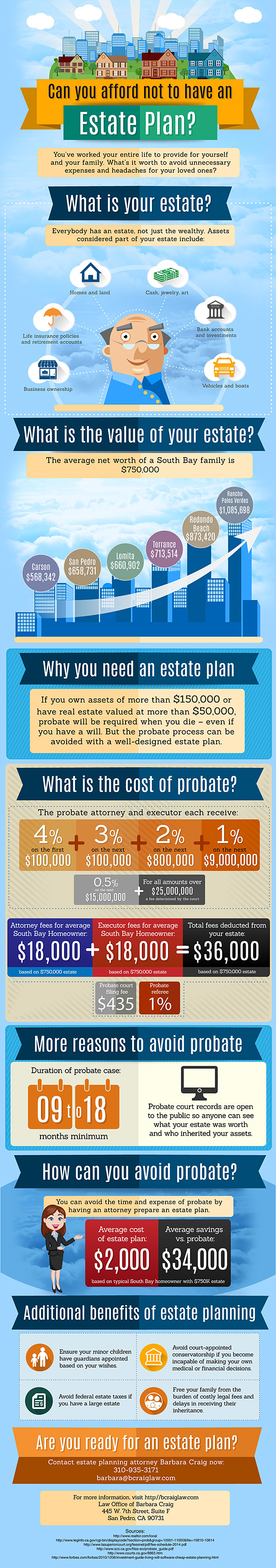

Estate planning is an action strategy you can use to identify what takes place to your assets and responsibilities while you live and after you die. A will, on the other hand, is a lawful document that describes just how assets are distributed, who takes treatment of children and animals, and any kind of various other wishes after you die.

Claims that are turned down by the executor can be taken to court where a probate judge will have the final say as to whether or not the insurance claim is legitimate.

The Greatest Guide To Estate Planning Attorney

After the stock of the estate has actually been taken, the worth of assets determined, and tax obligations and debt paid off, the executor will then seek permission from the court to disperse whatever is left of the estate to the recipients. Any kind of inheritance tax that are pending will certainly come due within 9 months of the day of fatality.

Each individual you could check here locations their properties in the trust and names somebody besides their partner as the recipient. A-B trust funds have actually ended up being less popular as the estate tax obligation exception functions well for most estates. Grandparents may transfer possessions to an entity, such as a 529 strategy, to sustain grandchildrens' education and learning.

The Definitive Guide to Estate Planning Attorney

This method entails freezing the worth of a possession at its value on the day of transfer. Accordingly, the quantity of potential resources gain at death is additionally frozen, permitting the estate coordinator to approximate their prospective tax obligation obligation upon death and far better prepare for the payment of revenue taxes.

If adequate insurance profits are available and the plans are properly structured, any type of income tax on the regarded dispositions of possessions adhering to the death of a person can be paid without resorting to the sale of possessions. Profits from life insurance policy that are obtained by the beneficiaries upon the death of the guaranteed are generally earnings tax-free.

There are certain files you'll need as component of the estate preparation procedure. Some of the most usual ones include wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a misconception that estate preparation is just for high-net-worth people. Estate preparing makes it much easier read this article for people to identify their desires before and after they die.

Our Estate Planning Attorney PDFs

You should begin preparing for your estate as quickly as you have any kind of measurable asset base. It's a recurring process: as life progresses, your estate strategy ought to change to match your conditions, according to your new objectives. And keep at check my site it. Refraining your estate planning can create unnecessary financial worries to liked ones.

Estate preparation is frequently believed of as a device for the wealthy. Estate planning is likewise a great method for you to lay out strategies for the treatment of your small children and animals and to describe your dreams for your funeral service and favorite charities.

Applications have to be. Eligible candidates who pass the exam will certainly be officially accredited in August. If you're eligible to rest for the exam from a previous application, you might file the brief application. According to the rules, no qualification shall last for a duration longer than 5 years. Find out when your recertification application schedules.